All Categories

Featured

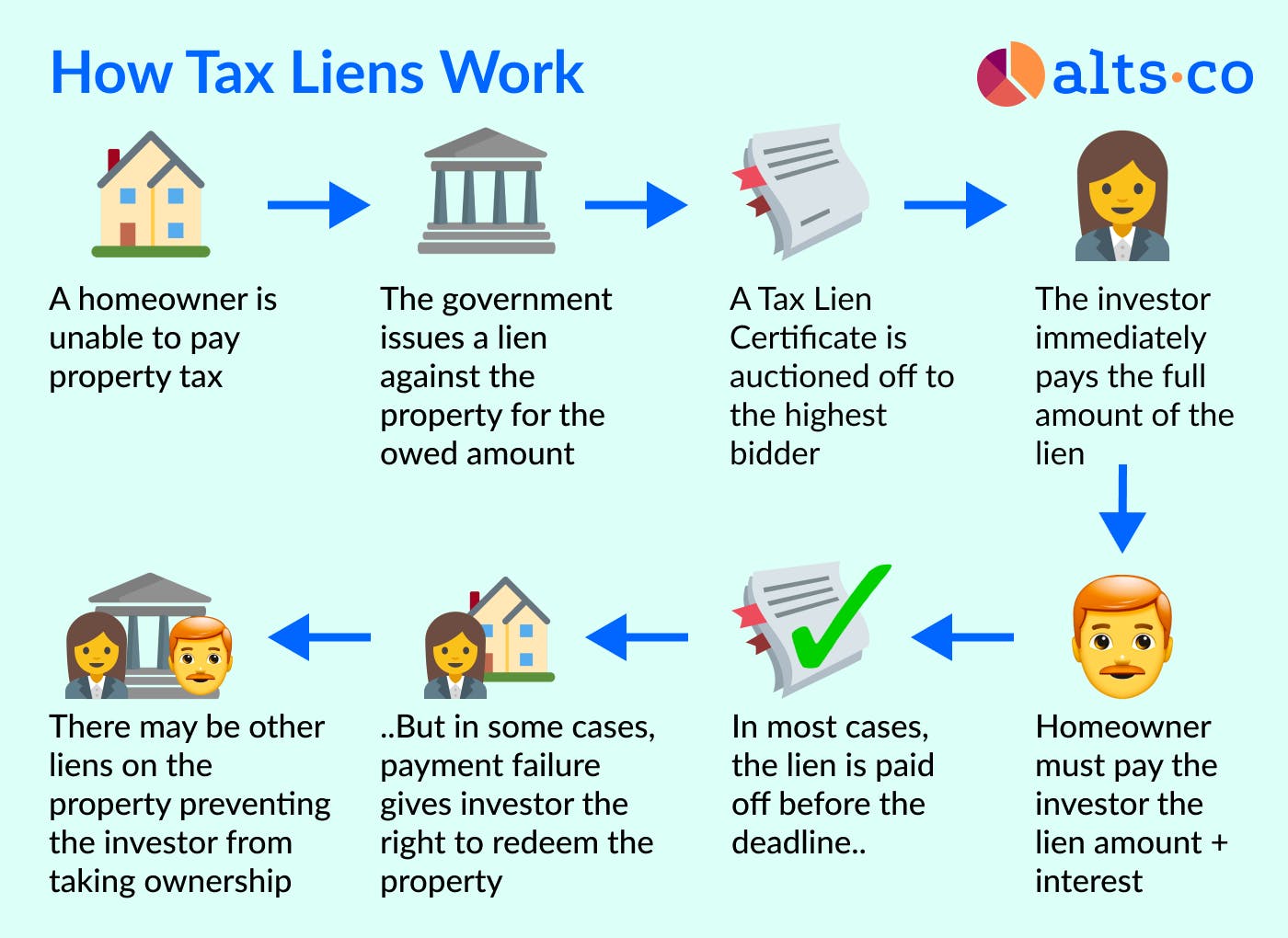

Spending in tax liens via acquisitions at a tax lien sale is simply that-an investment. All Tax Obligation Sales in Colorado are performed per CRS 39-11-101 thru 39-12-113 Complying with the tax obligation lien sale, effective bidders will certainly get a duplicate of the tax lien certification of acquisition for each building. Investing in tax liens with purchase at the tax obligation lien sale is just that, an investment.

Tax Liens Investing

When a property owner drops behind in paying home taxes, the area or district may place tax lien against the home. Instead of waiting for repayment of tax obligations, governments in some cases decide to sell tax lien certifications to exclusive investors. Your income from a tax lien investment will certainly come from one of 2 resources: Either rate of interest payments and late charges paid by house owners, or foreclosure on the home in some cases for as little as dimes on the dollar.

Latest Posts

Behind On Property Taxes

Back Taxes Homes

Tax Repossessed Property